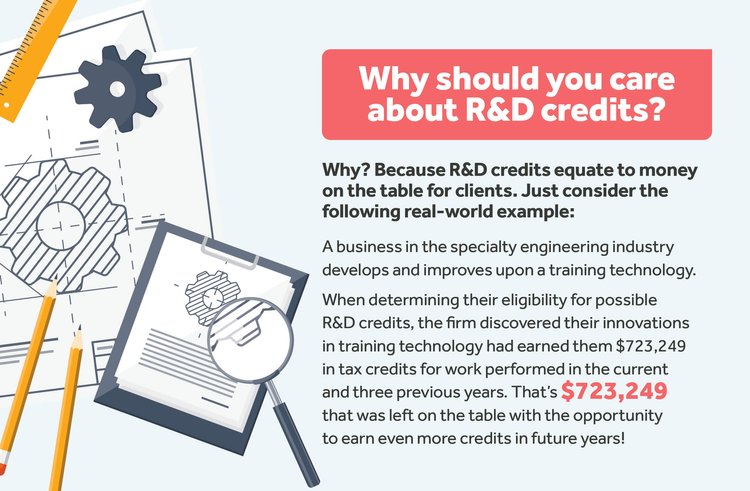

Federal and state research and development (R&D) tax credits are some of the least understood and least claimed tax credits available. The hard fact is that most businesses aren’t claiming their full potential. And that equates to leaving cash on the table. Big cash!

In simplest terms, this is a general business tax credit under IRS section 41 for any business that incurs R&D costs in the United States. In total, the government offers more than $10 billion to businesses for qualified R&D activities. This can include innovative activities such as developing or improving existing technologies, products and materials.

For firms, mastering R&D credits can open the door to a bigger advisory opportunity. One that may lead to significant unclaimed money for your clients—while making you look like a total rock star.

To help you maximize research and development credits for your clients, we’ve compiled a roadmap of sorts. It was designed to help you, first, gain a clear understanding of R&D tax credits and what they mean to your clients. And second, to guide you toward developing a lucrative new advisory revenue stream.

This roadmap is complete with a real-world federal R&D credits client example and links to other helpful resources. Now, let’s get started…

Identify clients who qualify

The first step is to identify those within your client base who qualify. To help you, let’s start with a few preparation suggestions:

- Dig into data: Conduct an inventory of your existing clients and maintain a spreadsheet of those who seem to qualify. If implemented, use your client intelligence management or client relationship management (CRM) platform, like HubSpot, to automate this process.

- Assign a communications champion: Identify one person in your firm who will take charge of client R&D credit communications—once you are ready to communicate it.

- Develop questions: Create a short list of questions that can help you further qualify clients beyond existing in-house data. Start with our list below and add to it as you expand your expertise in R&D tax credits.

The following list offers 10 good starter questions:

- Is my client within a qualifying industry?

- Are my client’s business activities being performed within the

United States? - Is my client growing or developing new products, solutions or processes?

- Has my client ever taken any tax credits?

- Was my client established in the last 5 years or less?

- Does my client hire programmers, coders or engineers?

- Does my client have at least 10 or more employees?

- Does my client use 1099 contractors to augment staff?

- Is my client profitable and taxable?

- Does my client’s gross payroll exceed $500k?

Once you’ve qualified clients, the byproduct should be an accurate list for communication purposes. But first, it’s important to understand what you want to talk to clients about and/or have a defined product in place to offer them. For example: R&D tax credit advisory.

Understand qualifying activities and industries

When you fully understand qualifying activities and industries, you’re better positioned to sell R&D credits as a service. Your goal should be to become the go-to source for your clients in this area.

Remember, you don’t want clients leaving money on the table. You want to be the expert that brings this to their attention and helps them claim credits due.

First, understand a few common qualifying activities:

- Product: This includes developing a new or improved-upon product.

For example: a medical device, pharmaceuticals, cosmetics. - Manufacturing process: A process could include changing the layout of a manufacturing facility to improve an existing process. Another example is a dentist who creates dentures or crowns in-house.

- Software: This includes creating a new website or platform for public or internal use. It can also include hiring developers in the US to do the work on new platforms or apps.

- Invention: An invention can include new software technologies that utilize new algorithms or automations; something that is patentable.

- Technique: An example of a technique could be a new way to brew beer or distill whiskey.

- Formula: Formulas could include new vaccines, medicines or therapeutics.

Second, understand some of the most common qualifying industries:

- Software

- Manufacturing

- Biotechnology

- Pharmaceutical

- Natural resources

- Services

- Real estate

- Agriculture

Note: While the above represents common qualifying industries, this list is not all-inclusive.

Also important to note is that even companies without a dedicated R&D department may be eligible for credits based on the level of commitment to developing new products, processes, software or inventions.

Create a defined product and advance your advisory role

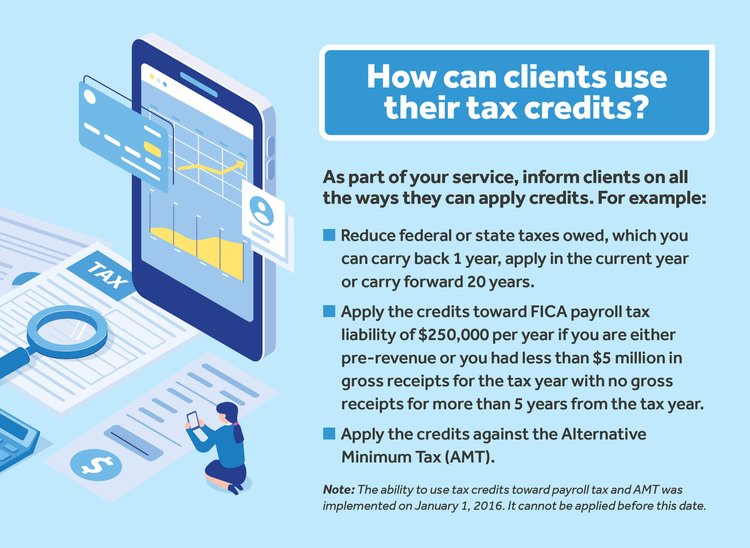

Your clients look to you for timely, accurate advice on just about everything tax- and accounting-related, including R&D tax credits. Becoming an expert in this area will help you elevate your advisor role and define an R&D credits product. You can advise clients on:

- If they qualify overall.

- What constitutes qualified research activities, such as software development, process of experimentation and improved product processes.

- How qualified small businesses (your clients) can apply credits.

- If they can retroactively collect credits from past years.

- How they can use tax credit to offset taxes owed.

- Tips and tactics for maximizing R&D credits each year.

Select an expert partner

To help streamline R&D tax credit services for your clients, leverage existing expertise from a proven and reliable partner. ADP® is a good example.

ADP offers a combination of R&D tax credit expertise, technology and resources to help make claiming tax credits for your clients as simple, streamlined and predictable as possible.

This makes developing an R&D product much simpler. For example, if you’re already using ADP for payroll, access to data is built in. ADP uses client payroll data to calculate tax credits and support compliance.

Give credit where credit is due!

R&D tax credits represent a new opportunity to expand your advisory role and support clients with a much-needed service.

Year after year, qualifying businesses leave money on the table. And simply because they’re not aware of the credit and/or how to claim it.

This is where your firm comes in.

Take a big advisory step forward and be the go-to R&D tax credit source for your clients. Not only will you strengthen the client-advisor relationship, but you can also help to further secure the financial success of your business clients.

ADP is trademarks of ADP, Inc. and its affiliates. All other marks are the property of their respective owners. Copyright © 2022 ADP, Inc. All rights reserved.