Tax season killing your firm? Smart Client Management is the fix

Let’s face it. For many accounting firms, tax season just plain sucks.

Yes, we said it. Tax season is grueling, it feels like it’s never-ending…and work-life balance? Pretty much non-existent.

And it’s killing your firm.

But there’s a light at the end of the tax-season tunnel. And it’s called Smart Client Management (SCM). What is it? It’s pretty simple. SCM is a modern concept, that when applied properly, helps foster year-round (and long-term) success by focusing on WHO you want to serve, WHAT you want to sell and HOW you want to deliver products.

Once you’ve defined those three key areas—and start actively managing these aspects of your firm—hellish tax seasons start to become a thing of the past.

Create a modern business strategy

Many firms are using a traditional, yet outdated, business model. One that leads to taking on too many not-such-a-great-fit clients, burned out staff, the inability to serve clients well, underperforming products or services, and a heavy reliance on your tax season revenue stream.

If this sounds like your current business strategy, it’s time to start thinking about a more modern approach. A modern firm’s business model includes:

- Ideal clients: The people you love to serve and are good at serving.

- High-performing products and services: The services you’re great at providing, including “off-the-shelf” products that are repeatable across all clients.

- Seamless delivery of services: The frictionless way your tech stack is implemented to onboard and serve your clients.

When you start making the shift to a modern business model (keeping that WHO, WHAT and HOW in mind), you need to start with your client list. It’s time to determine who you can best serve and say farewell to the non-ideal clients (diplomatically, of course).

Determine your tax client capacity

If your firm suffers through tax season, chances are you have too many tax clients and your team is struggling to keep up with the volume through each tax deadline. The way to solve this problem is to calculate your firm’s tax client capacity. To do this, you’ll need to have access to your tax season billing information from your practice management system.

Next, ask yourself these three questions:

- What is the average time spent per tax return? For this example, we’ll say 1.5 hours.

- Which of our tax clients has the highest realization rate?

- What is our staff’s utilization percentage outside of tax season? Let’s assume staff is 75% utilized during non-tax season times.

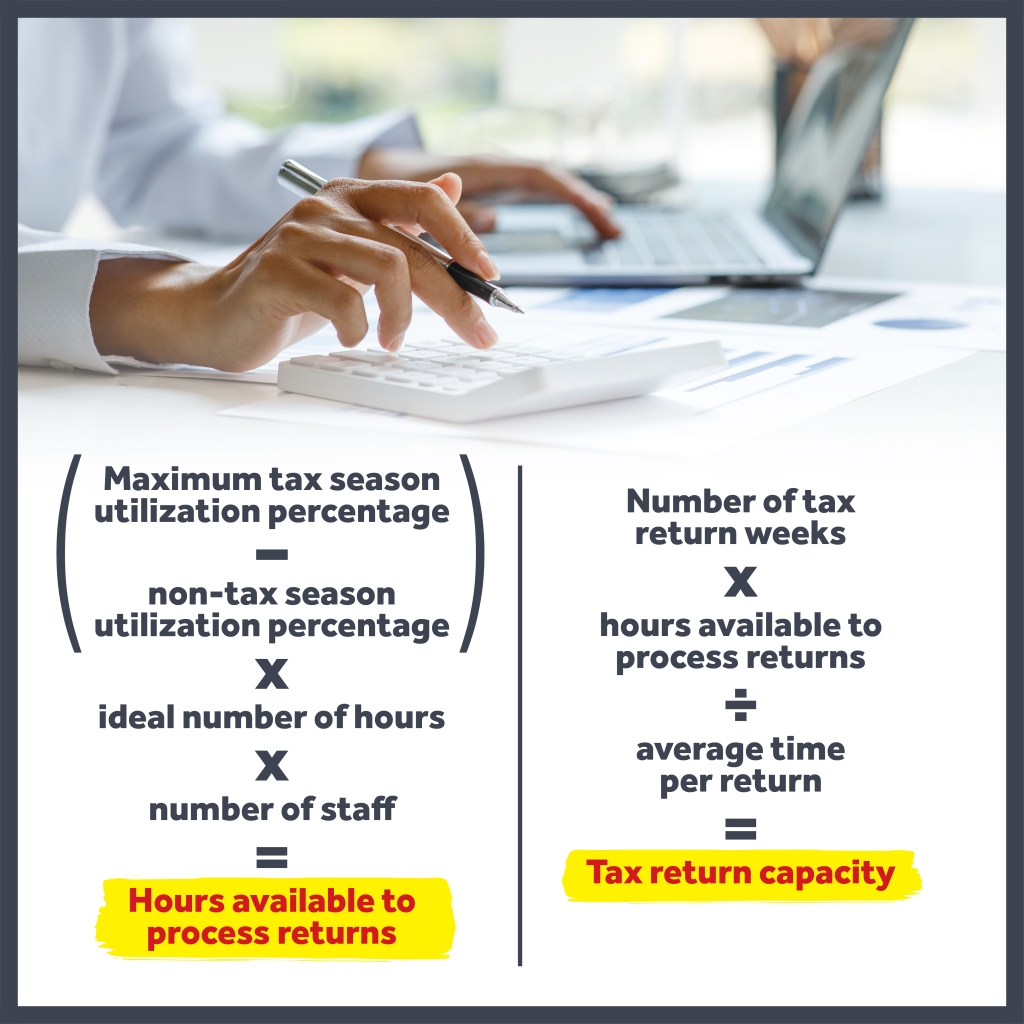

Now, let’s determine your firm’s tax client capacity number:

- Start with the ideal number of hours you and your team want to work during the busy season. We’ll use 44 hours per week (110%) for this example.

- We’ve assumed that staff utilization is at 75% outside of tax season.

- Considering the above, your tax season capacity is at 35% of 44 hours per tax staff person (110% maximum, less 75% non-tax season utilization)—times the number of team members working on tax (we’ll assume you have three). That’s four hours at 35%, which is roughly 15 hours per week. Multiply that by three staff members and that’s a total of 45 staff hours per week available to process tax returns.

- Next, calculate the number of weeks per year that you’ll work on tax returns. Let’s consider 8 weeks of busy season and 6 weeks of extension season, giving us a total of 14 weeks. In step 3, we calculated a total of 45 staff hours per week, which brings us to a total tax return capacity of 630 staff hours.

- Now, bring in the average time spent per tax return. Divide the total tax return hours available (630) by the average time spent per return (1.5). This is the capacity your firm can handle during tax season. (Hint: It’s 420 returns.)

Whew…that’s a lot of math! But as numbers people, you get it.

If you’re doing, say, more than 700 tax returns, you can see you might have a problem. And, unfortunately, you may need to start identifying clients to let go. To help you with this, you can raise your fees (and see who stays or goes) or you could outsource the overage. But keep in mind, you’ll need to make up that revenue somewhere. And that’s where your ideal clients come in.

Develop your non-tax client roster

As a refresher, your ideal clients are those you want to serve and are good at serving. These clients use many of your services; they pay their bills on time; they’ve adopted your tech stack for a seamless experience on both sides. The focus on non-tax client expansion starts with your ideal client.

Instead of focusing on taking any client who walks through the door (remember, all those tax returns put your firm over capacity!), focus on the serving the clients who:

- Purchase services often

- Spend a considerable amount of money with your firm

- Pay on time

- Use your tech stack

Start by listing out the characteristics of your favorite clients and then compare your client list with those characteristics. If you have clients who don’t adapt to the technology you use, only come to you during tax season and don’t pay their bills on time, it’s time to break up. Retain the clients that continue to use your services throughout the year.

Extend your recurring revenue

Many firms make the mistake of relying on tax season revenue to support their firm during the non-busy season. The focus is on the short-term tax season revenue and bringing in as many clients as possible—instead of thinking about annual recurring revenue.

Modern firms provide year-round services, like payroll, retirement plan advisory and cash flow advisory (to name a few). Instead of constantly looking for new clients, you should be taking advantage of the opportunities right within your client list: upselling and cross-selling to clients who need your services.

Making recurring revenue part of your business model is not only critical to Smart Client Management. It also removes the reliance on tax season revenue to carry your firm through the year.

Enjoy your tax season

Tax season doesn’t have to suck. Take a step back and review your current business model. Does it best serve your firm, your staff and your clients? If it doesn’t, shift to a modern business strategy, reduce the number of tax clients you serve and focus on building your ideal client list. Your firm will thank you.

Here’s to tax season 2023! You’ve got this!

For more information on Smart Client Management, check out our eBook.