Busy season is right around the corner. And while we don’t suggest implementing new automation tools or changing an accounting process during tax season, there’s still time right now to make adjustments so this upcoming busy season…well…sucks less.

Sean Hanthorn, Director of Education Services for Rootworks, tells us how to prepare for the upcoming tax season and about the leading role that automation should play in every firm.

What are you hearing from Rootworks member firms about their biggest challenges going into busy season?

The main challenges we hear coming into this tax season are:

- Having the correct staff and experience to get the work done.

- Having too many clients based on the capacity the firm can handle.

- Managing costs along with increasing pricing.

As someone coming up on his eighteenth tax season, what do you see firms struggle with the most?

Over the past three years, we’ve seen firms struggle more and more with staffing. The traditional model accounting firms have relied on for years (i.e., working long hours, six to seven days a week during tax season) isn’t what most staff are willing to do these days. It’s imperative to adjust that model so that burnout is less extreme.

When it comes to firms being short-staffed, what steps should they take to get ready for tax season?

Firms should first look at their internal processes because there are likely too many manual steps taking place. Within those processes, they need to see if an item of technology can improve that process.

Second, firms should start to use technology to do some of the data entry or outsource their work. The popularity of outsourcing—whether onshore or offshore—has grown exponentially.

What would you say has changed from pre- to post-pandemic in terms of the experience firms provide for their clients? What about for their staff?

We found most firms put minimal focus on their client experience pre-pandemic. Many firms would have a portal that clients may or may not have used, but they didn’t focus on looking at the firm from the client’s perspective.

Now, we see firms having people in charge of communications with clients, offering services digitally and meeting more virtually. The pandemic has lowered people’s patience with bad service, so it required firms to step up their game.

The staff experience has also changed quite a bit. In 2018 or 2019, a portion of firms were virtual or allowed staff to work virtually. It was still a very “butts in seats in the office” business model. Now, firms trying to recruit and retain the best talent have had to improvise and adjust their business processes to make the job more attractive.

What’s the biggest thing that drives staff members away from firms?

There are two: burnout and management of firms. And they go hand in hand. If owners manage firms the same way they did 10 years ago (i.e., billable hour requirements and very long hours during tax time or other deadlines), staff members start looking for options that provide a better work-life balance. We’ve seen firms throw money at staff to keep them, but money is only part of the equation when it comes to retaining staff.

What are staff members looking for in a firm, and how can firms attract and retain the right people?

Balance. Staff members are looking for firms that do things in a more modern way: freedom with work hours, the option of remote work, and goals that are production-focused instead of billable hours-focused. While salaries also matter, the work environment and expectations carry more weight.

How important is an IT infrastructure plan for firms?

I’d say it’s extremely important. If you don’t have a focus on your IT infrastructure, you’ll end up so far behind the times that by the time you make it a priority, you may never catch up. Every firm should have an IT budget that includes a maintenance and improvement plan.

What are the advantages of firms going digital?

If you can go digital as a firm, you now have a talent pool to choose from across the country, instead of just locally. You’re better prepared if a major storm or, heaven forbid, another pandemic makes an appearance. Now, you can offer services to clients easily, no matter where they’re located.

What are the steps firms can take to digitize everything?

It starts with diving into your current processes. If you’ve already documented your processes, then you just need to find accounting automation tools or implement a service that can help standardize and automate your processes. You also need to ensure that the infrastructure of the tools you use is sufficient to support the digital environment. See why an IT infrastructure plan is important?

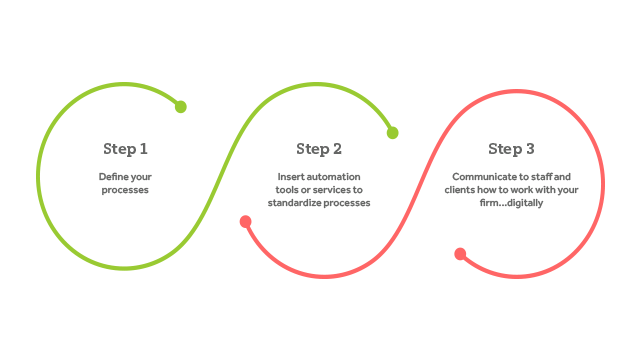

To break it down:

- Define your processes.

- Insert automation tools or services to standardize processes.

- Communicate to staff and clients how to work with your firm…digitally.

Are there specific tools you can recommend for the tax return process?

I’d recommend accounting automation software that supplements your current tax software. SurePrep® has a scanning/OCR solution that helps the upfront process. If you have a significant tax practice, SurePrep’s TaxCaddy enhances the pre-preparation stages. If you do a lot of handholding or spend a lot of time on delivery, SafeSend Returns is a great solution to automate the delivery process.

Not only does automation software streamline processes and give you real-time insight into where each return stands, but it also saves time for you, your team and your clients.

What is the role of a Client Communications Manager, and why are they important to a firm?

I think that communications from your firm need to be consistent and clear for an exceptional client experience. The Client Communications Manager sends all bulk communications, like client reminders, deadlines, office information and more to your clients. This person helps create a consistent message from your firm instead of each staff member attempting to relay accurate information to your clients. This helps streamline your communication process.

What are the best practices to follow when implementing a Client Communications Manager?

First and foremost, let the Client Communications Manager own the communications coming from the firm. This can include email, mail, your web presence and social media. Owning the communications means that, as a business owner, you may have input, but you ultimately allow the Client Communications Manager to control communications. They control the timing and messaging, and create the communication strategy for the year.

Can you tell us more about what a notice protection plan is and why firms need one?

Notice protection plans essentially cover your firm for the time spent responding to tax notices. Often, firms handle these notices throughout the year and are reluctant to bill for them. Notice protection plans are a way to give clients peace of mind for bringing those notices to your attention to handle, as well as set a precedent that you will bill a client for notice responses if they decline your notice protection plan.

How would you recommend establishing a notice protection plan?

I have two recommendations:

- Pick a percentage of their bill (we recommend 20%-25%) and add it as a line item.

- Have clients opt out of the plan versus opting into it.

We’ve found that only about 20% of people opt out of the notice protection plan. But it sets the boundary that you will charge them if they come back to you with a tax notice. (Bonus: This helps with the bottom line of your cash flow.)

Darren Root, Chief Strategist for Right Networks and Founder of Rootworks, has mentioned that not all tax returns are created equal. Can you speak more about tax return levels and how firms can take advantage of defining them?

This is correct. The reviewer is almost always the bottleneck in a firm getting returns processed and out the door. While we all want to follow a defined process for returns, one of the worst things that happens on the tax side of the business is being too strict on the return process.

Due to unique complexities, some returns definitely need to be reviewed by a partner, manager or owner, but we’ve found that almost 60% of returns can skip that review process. That’s why leveling returns allows you to pick returns that are more basic or are at a level that an experienced preparer can complete (Rootworks members: Learn more about this in our online learning library).

Typically, you’ll start with a handful of Level 1 returns—the ones that don’t require a review and will go from the preparer to your processing stage. Once your firm becomes comfortable with all the staff preparing returns, your definition of a Level 1 return will likely change. There are also returns on the other end of the spectrum…ones that are too complex or outside your firm’s scope of expertise. Those should be outsourced.

What’s one of the biggest advantages firms see when defining tax return levels?

We’re actually seeing three advantages:

- The reviewer bottleneck is less of an issue.

- Firms typically have fewer extensions.

- Returns get out the door more quickly, meaning fewer hours worked by all staff during tax season and extension season.

Defining tax return levels is the best solution to reduce tax season burnout without getting rid of clients.

How can firms determine what to outsource during busy season?

Firms need to start by evaluating their capacity. This should include what expectation or limit of hours they want their team to work, the average amount of time spent on returns, and then determining where the firm is currently. If you track your capacity and you’re underwater or your expected hours are extreme, you need to consider outsourcing returns.

Firms should consider outsourcing returns that fall outside the experience of the firm. This way, you don’t spin your wheels on returns to maintain client relationships. But you have someone more experienced in that particular case preparing the return.

What advantages do firms gain by outsourcing returns?

Firms gain the ability to retain clients they would otherwise have to remove because of capacity constraints. There’s also the advantage of utilizing experienced internal staff as reviewers while outsourcing returns that moves the more time-consuming step of preparation off their plates.

Firms can keep their current staff on a good trajectory of hours worked and their own work capacity, keeping morale higher and allowing firms to service their clients with minimal disruption. This also helps firms with the staffing woes of finding qualified staff.

Any final words as firms head into busy season?

Plan ahead. Put your client communications and reminder plans together; work on your capacity and make sure you set your firm up for success before the chaos of busy season begins.

And the last of my final words: Remember that life exists outside the firm. Make sure expectations for busy season are reasonable for all members of the firm so they continue to like—if not love—their job.

Learn about additional opportunities for accounting process improvement and what tasks you can automate for this tax season by watching our webinar.