Now that we’re dusting ourselves off post-pandemic, you’re probably wondering how you’re going to survive—much less thrive—through busy season with the challenges we’ve been facing. Challenges like a shortage in staffing, the need for a better client and team experience, and the need to take control of tax season.

If you approach this tax season the way you always have, you’ll continue to struggle through the same challenges. You have to shift the way your accounting firm does business, and that starts with your business model. Not only does it define your WHO, WHAT and HOW, but it’s a big key driver of your firm culture.

You already know that your client list and your team are your firm’s two most valuable assets, but your business model must reflect this. If your tax return capacity is 500 tax returns but you’re doing 750, your business model doesn’t support your staff.

The goal isn’t just to survive tax season—it’s to maximize your incredibly valuable assets. That’s why we’ve curated four tax season survival tips so you can take control of tax season.

Go digital

One of the first things you can do is digitize everything in your firm. Relying on paper and traditional methods causes unnecessary bottlenecks and wastes valuable time for both your staff and your clients. Not only will you streamline the return process, but you’ll create efficiencies—and save time—right off the bat.

Think through all the touchpoints in your current process and determine what you can improve upon to get full adoption from both staff and clients to go fully digital. Here are four things to consider when evaluating your current process:

- Gather. How do you gather documents? If the answer includes any variation of “our clients will drop them off or mail them to us,” then you have some work to do. Clients are fully capable of scanning, sending and uploading documents—and chances are they’d prefer to do it this way. Use an application like TaxCaddy by SurePrep® and stay ahead of the game by allowing your clients to upload documents all year long.

- Prepare. How will you organize and prepare tax returns? Do you have a simple way to access last year’s information? A tool like SPbinder by SurePrep automates the tax return process by bookmarking and organizing tax documents, while TaxCaddy allows you to see what documents may be missing.

- Review. How will you quickly and easily review returns? We’ll talk about one method for cutting down on review time for tax returns a little later, but one way to save time is to use an application like SPbinder. All documents are organized in a standardized manner to make the review process a breeze.

- Deliver. How do you deliver returns? Use SurePrep’s online and mobile tools to simplify the delivery process and allow clients to pay tax bills all in one easy-to-use location.

Take the time now to consider the right tax software for your firm, as well as other applications that will help get your clients onboarded to 100% digital. The time savings alone will be a game-changer.

Streamline communications

In a traditional firm, everyone’s job—from tax preparers and managers to partners and other tax professionals—is to communicate with clients throughout tax season. The caveat is that your firm’s processes can become inconsistent, and you lose time to the lack of streamlined communications.

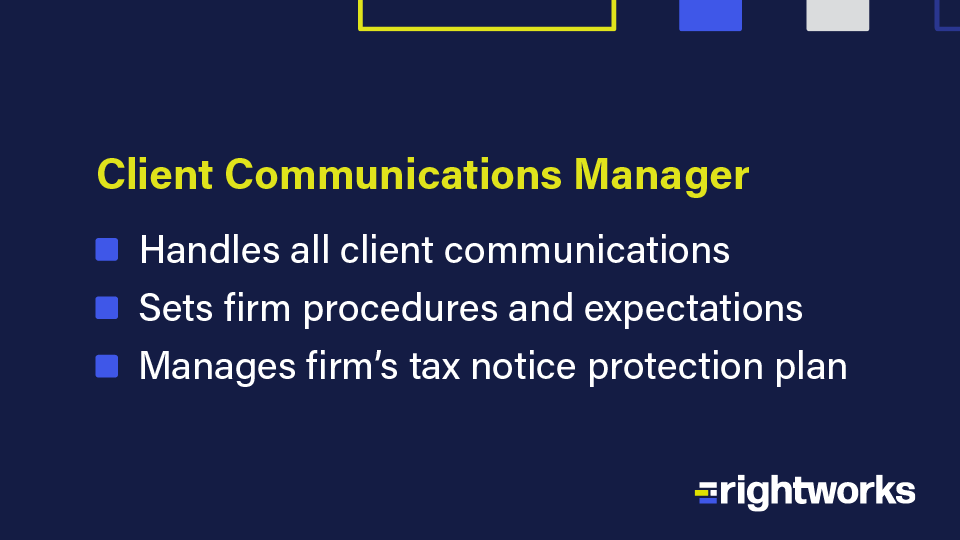

To modernize your firm, think of someone in your office who is good with people. They excel at details and would love to be the one central hub of communication with all clients. Make that person your Client Communications Manager. They’ll handle all client communications, set firm procedures expectations (i.e., going 100% digital) and manage your firm’s tax notice support plan (more on that next).

For the upcoming tax year, make it your goal to maximize production for preparers and reviewers by having all communications go through your Client Communications Manager.

Implement a notice protection plan

Another tax season survival tip that saves time is establishing a notice protection plan. Clients worry that they’ll receive tax notices, and many firms are unsure whether they should charge for them. We highly recommend that you add a line item to every tax return (we recommend 20%-25% of the tax return line item) called “notice protection plan,” and allow clients the option to opt out.

Doing this not only increases your bottom line, but it sets a boundary informing your clients that you’ll be charging for tax notices. We’ve found that about 80% of clients don’t opt out of this service. Thanks to the added income coming from the notice protection plan line item, you now have the option to say farewell to the tax returns of your not-so-ideal clients. It’s a win-win for you and your staff when it comes to time savings (and a morale boost)!

Create tax return levels

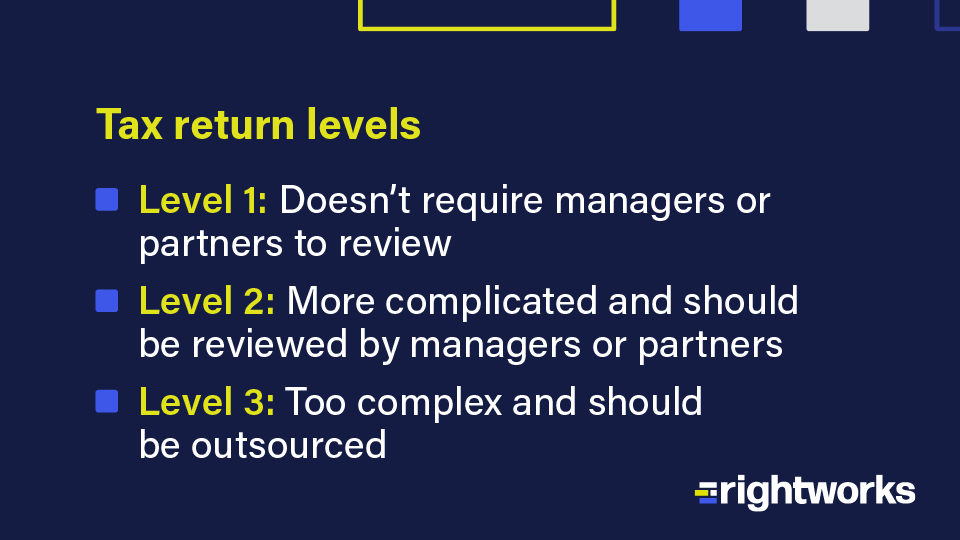

Not all tax returns are the same, so you need to stop treating them as such. Don’t get stuck reviewing 1,000 returns this year (or ever again). Use your team’s expertise and define three levels of tax returns: Level 1, Level 2 and Level 3.

- Level 1 includes income tax returns that don’t require a manager or partner to review (e.g., W-2s, social security income, interest income). These can be prepared and returned by experienced tax preparers and can account for about 70% of your returns.

- Level 2 returns need to be reviewed by managers or partners because they’re typically more complicated.

- Level 3 consists of returns you’ll want to outsource because they’re too complex or outside your firm’s scope of knowledge (e.g., capital gains, hedge funds, multi-state complexities).

Take the time to print your client list and organize them into the appropriate tax return levels. Then, create a process for each level to make the upcoming tax season as efficient as possible.

Implement these tax season survival tips

Tax season is like a marathon. Without the proper preparation, it can be long and grueling. Use these four tax season survival tips to take back control, increase productivity and maximize time savings for your firm.

Subscribe to our blog below for more actionable tips.